What Will Bitcoin Look Like in Twenty Years?

Prediction is a tricky business.

It’s so easy to be wrong and so hard to be right.

But that’s exactly what we’ll do here. Since we’re rapidly approaching the ten year anniversary of Bitcoin’s whitepaper publication, I’ll attempt to project out twenty years to see the evolution of Bitcoin, blockchain, alternative cryptocurrencies and decentralization.

This is the type of article that will look unbelievably foolish or incredibly brilliant when I’m old and gray.

I don’t care. I’m going for it anyway.

I’m also going to go much, much deeper than “Bitcoin will go to zero” or “Bitcoin will become the reserve currency and be worth $1,000,000”. That’s not really saying all that much and anyone can do it.

Instead we’ll look at how the technology will transform and how society will transform with it.

I’ve got a decent track record of successfully predicting future trends and technology but nobody gets it 100% right. Arthur C. Clarke, one of the greatest sci-fi writers of all time, saw the coming of satellites and GPS, as well as the cloud, the Internet and telecommuting but by his own admission he overestimated the importance of rockets and failed to see the importance of a prototype laptop a company gifted to him to write his next novel.

Chaos theory tells us it’s impossible to predict the future.

But that’s not entirely true.

We can never see black swan events or completely unexpected technology (try explaining a computer and the Internet to an 18th century farmer) but we can do a kind of Monte Carlo analysis of tomorrow and see the major pathways spinning out into infinity.

Few people can do it well.

In fact, most people get the future laughably wrong so before we leap into our predictions, we need to understand why so we can try to avoid the same mistakes.

This Internet Thing will Never Work Out

The first reason people get the future so wrong is because they dedicate about five minutes to looking at something before they form an opinion on it.

That isn’t thinking.

That’s the primordial lizard brain running a mental heuristic that’s absolutely incapable of understanding anything new and novel. It’s only good at attack, defense, finding food and shelter and avoiding boredom. It’s a survival machine.

Unfortunately, many people live almost their entire lives at this level and their opinions are worth zero when it comes to seeing new trends and developments.

The second major reason people get the future so wrong is it goes against everything they understand about the world. Think about a company like Kodak who simply refused to see the power of digital film because they’d built up a business over a hundred years on the back of the chemical film. They had every advantage and they blew it. They mistook the past for the future and they paid a heavy price by going bankrupt as the market roared past them. To see the future you have to be able to step outside of yourself, forget your past successes and see beyond your current understanding.

A third major reason people fail to see the future is that it challenges their position of power. That’s why oligarch banker, Jamie Dimon, and a prince from a country that just allowed women to drive last month, all see Bitcoin and cryptocurrencies as a “fraud” or a “scam”.

They literally can’t see clearly because they’re the main beneficiaries of the current system. They don’t want to see. So they engage in a kind of information warfare, even if it’s unconscious. It’s nothing but a mental defence mechanism. The rise of new ways of running the world means their position is under fire and they’re terrified.

Asking these people about Bitcoin is like asking a taxi driver what he thinks about Uber or a horse and buggy manufacturer what he thinks about cars. Their opinions are worth less than nothing.

The fourth major reason people screw up predictions is that they mistake their opinion for reality. There’s what you think about the world and there’s actual reality and they’re often not the same thing. One is the map and one is the territory. Don’t mistake the map for the territory.

Take this now infamous article by Clifford Stoll from Newsweek in 1995 that declared the Internet a total failure poised for imminent collapse. Stoll writes:

“Visionaries see a future of telecommuting workers, interactive libraries and multimedia classrooms. They speak of electronic town meetings and virtual communities. Commerce and business will shift from offices and malls to networks and modems. And the freedom of digital networks will make government more democratic. Baloney.” [Emphasis mine.]

Reading that quote it’s impossible not to grin ear to ear as feelings of tremendous superiority wash over you. What an idiot! Who didn’t see the Internet coming?

Answer: Almost nobody.

Hindsight is 20/20.

I’m betting almost everyone busting up laughing at the poor guy didn’t see it coming either, if they even knew what the Internet was in the first place. If they did they almost certainly didn’t see a working Wikipedia, the rise of telecommuting and a day when they would buy everything from books to groceries through Amazon.

Actually what’s most striking about the above quote is not how inaccurate it is, but how accurate it is on so many levels.

That’s right.

Read the article and you’ll see tons of his predictions are incredibly spot on!

If you go back and strip out all Stoll’s opinions what emerges is an amazingly clear picture of the next two decades of the net. Check it out:

“Nicholas Negroponte, director of the MIT Media Lab, predicts that we’ll soon buy books and newspapers straight over the Internet.”

I yanked two words: “Uh, sure.” His opinion.

Stoll saw the future, he just refused to see it. If he managed to get out of his own way and just observe instead of interpreting and filtering what he saw, the article would have gone down in history as one of the most forward thinking and accurate ever written. That brings us to our next reason.

The fifth reason people get the future wrong is a complete and total lack of patience.

Take the opening line of Stoll’s article:

“After two decades online, I’m perplexed.”

Stoll had already lived with the Internet for twenty years but it just wasn’t coming together for him. It’s easy to think it’s never going to happen when that much time goes by

The waiting is the hardest part. It takes patience to let things develop naturally.

Patience. Patience. Patience.

Creativity requires setbacks and failures and tremendous tenacity. Once you expose your idea to the reality of rust, gravity and friction, things tend to fall apart. No plan survives contact with the enemy. Reality is a whetstone that either shatters you or sharpens your ideas.

Things take time.

A classic example of the real creative process and how long it takes comes from George de Mestral, the inventor of Velcro.

He first came up with the idea in 1941, after taking his dog for a walk in the woods and seeing a bunch of burrs attached to his fur. The concept didn’t fully take root in his mind for another seven years. He started working on recreating the tiny hooks in 1948 and it took him ten years to make it work and mass produce it.

After that he opened his company in the late 1950s, he expected immediate high demand.

It didn’t happen.

It took another five years before the budding space program in the 1960’s saw Velcro as a way to solve the problem of getting astronauts in and out of bulky and unwieldy space suits. The rest of the world only cares about the problems things solve for themnot the idea or ideology behind it. Soon after the ski industry noticed it would work on boots.

All in all from initial idea to functioning, profitable business?

About twenty five years.

Lastly, we can take one more lesson from Stoll before I launch into my predictions for crypto.

His biggest mistake is the sixth and final reason people are blind to the future. He took current inventions, air lifted them forward and imagined them as the solution to future problems. Wrong!

Current inventions solve current problems. Future problems will take brand new solutions.

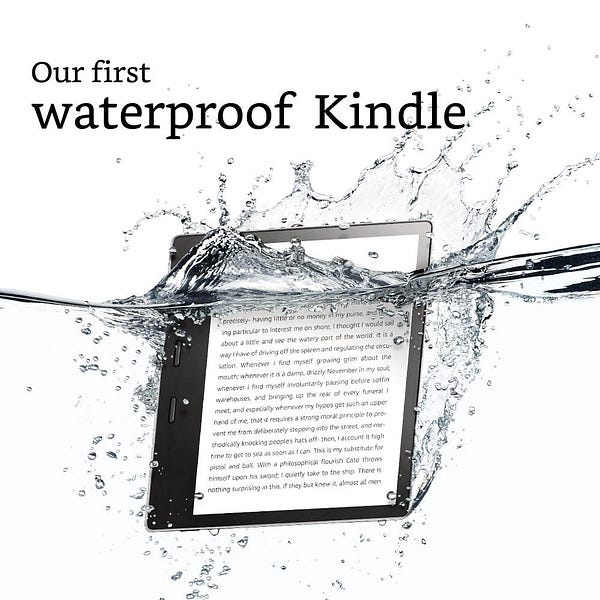

In the article Stoll mentions that CD books would never replace real books. He was right that reading books on CD with a crappy CRT monitor that rips apart your retinas was a miserable experience. But understanding that helps us understand the necessary characteristics of a future solution.

It’s nearly impossible to know what form those solutions will take, but we can figure out what traits the solution will have so we can recognize it when it gets here.

Let’s see how it works:

CDs are clunky. Monitors back then were blurry and hard to read. They hurt the eyes. Computers were huge and not very portable. Even laptops were bricks that burned your legs that nobody would want to read a damn thing on.

But he also missed the shortcomings of books.

Books are heavy too. They’re made of trees! And they can easily get lost or damaged by the elements. You can only carry so many before you’re carrying a huge weight around.

From there we can see that a good solution would be:

- Super-portable and lightweight.

- Have a crystal clear display.

- Hides the data storage completely from the user.

- As easy to use as a book. Just open and read.

- Protect the data so if we lose it or damage it, we can recover it without needing to buy it again.

- Allow you to carry lots of books at once.

Of course we know the answer now: the Kindle and the iPad.

Both have tremendous ease of use, hide the storage media from the user completely, protect the data by backing it up and they’re easy on the eyes.

Solutions start by pointing out what’s wrong, asking the right questions about how to fix it and correctly defining what properties we would need to have a better experience.

From the above, we have three principles to help us predict the future:

- Patience.

- Observe, don’t interpret.

- Don’t graft today’s solutions onto tomorrow’s problems.

All right, let’s break out the crystal ball and peer into the fate of Bitcoin and crypto.

Hopefully we’ll have better luck than Stoll and this article won’t get trotted out by tomorrow’s Boing Boing replacement to call me an idiot.

The Rise of Bitcoin, Crypto and Decentralization

We’ll start with a few easy predictions and move on to some more complex and far reaching ones as well as some seriously controversial ones.

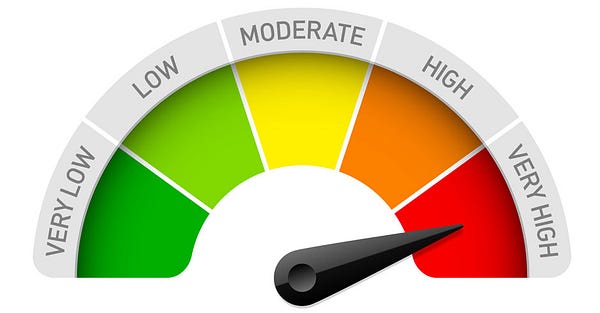

I’ll also include a confidence meter to let you know how strongly I feel about the scenario playing out.

1) The Bubble Bursts

People in and out of crypto see them as bubble that will pop, causing prices to crash badly.

They’re right.

But so what?

That’s not the end of the story. It’s just the beginning.

Right now we’re in the grips of tremendous euphoria. There’s so much potential. We can practically taste the decentralized future. It’s just around the corner! Any day now.

Of course, that’s almost certainly not how it will work out. The bubble will pop. Vitalik is right. 90% of tokens will fail.

But after the pop comes the real working ideas.

Eight years into the crypto experiment, everyone is working on the railroad tracks of the future but we don’t have much to show for it other than speculative trading and some smart contracts. The apps are hideous and practically unusable. It’s nerve wracking when you push “send” and blast $5000 across the web to someone. Better hope you copy and pasted that address right so your money doesn’t disappear into the void!

When the Internet bubble burst many of today’s marquee companies saw their stocks crash 85%. Yet they survived and the best was yet to come. Amazon and Google went on to dominate the world.

The same will happen in crypto.

The 10% of projects that make it through the bloodbath will turn into the Amazon, Google and Facebook of tomorrow and likely even the JP Morgan and Goldman Sachs as well, not to mention maybe even the governments of the future, like digital direct democracies or liquid democracies.

Innovation is hard work. You’re literally trying to create something that doesn’t exist!

There are no guidelines, no working templates, no business models to clone. There’s nothing. You’re on your own! It’s just you and your imagination. With those odds of course, 90% of people and companies fail!

It doesn’t matter.

Crypto, blockchain and triple entry accounting are probably the most important invention of the last 500 years so they’re not going to go gently into that good night.

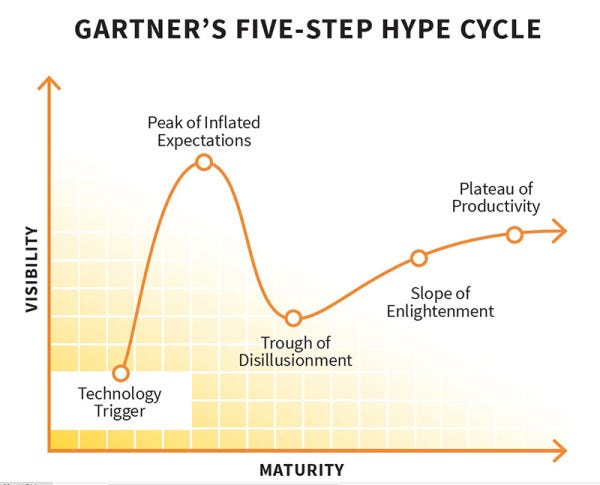

The bubble burst is just the next step. Three years after that the tech will really mature and take off running.

Source: Hackernoon